Remodeling spend will not keep pace with its steep 2018 increases in 29 of 49 major metros across the U.S., according to a new report from the Joint Center for Housing Studies (JCHS), a Harvard University initiative that researches housing issues relevant to public policy.

The JCHS report leverages a modeling tool, which forecasts residential remodeling volume and spend projections across the country’s largest metro areas. Researchers used two decades of historical residential remodeling permits, leveraging BuildFax data among other sources, as a benchmark to develop their model. The resulting indicator forecasts the annual rate of change in spending for the current quarter and subsequent quarters.

Housing Slowdown Impacts National- and Metro-Level Construction Indices

JCHS Managing Director Chris Herbert attributes the slowdown in remodeling spend to the housing market slump. This aligns closely with BuildFax research, which has also been tracking a steady decline across a number of key housing indices on a national level, including single-family housing authorizations, maintenance and remodeling activity.

As of May 2019, housing slowdown has persisted for at least six months with no indication of a reversal. Our research reveals declines in one of the key declining indicators, single-family housing authorizations, are closely correlated with historical recessions between 1980 and 2018.

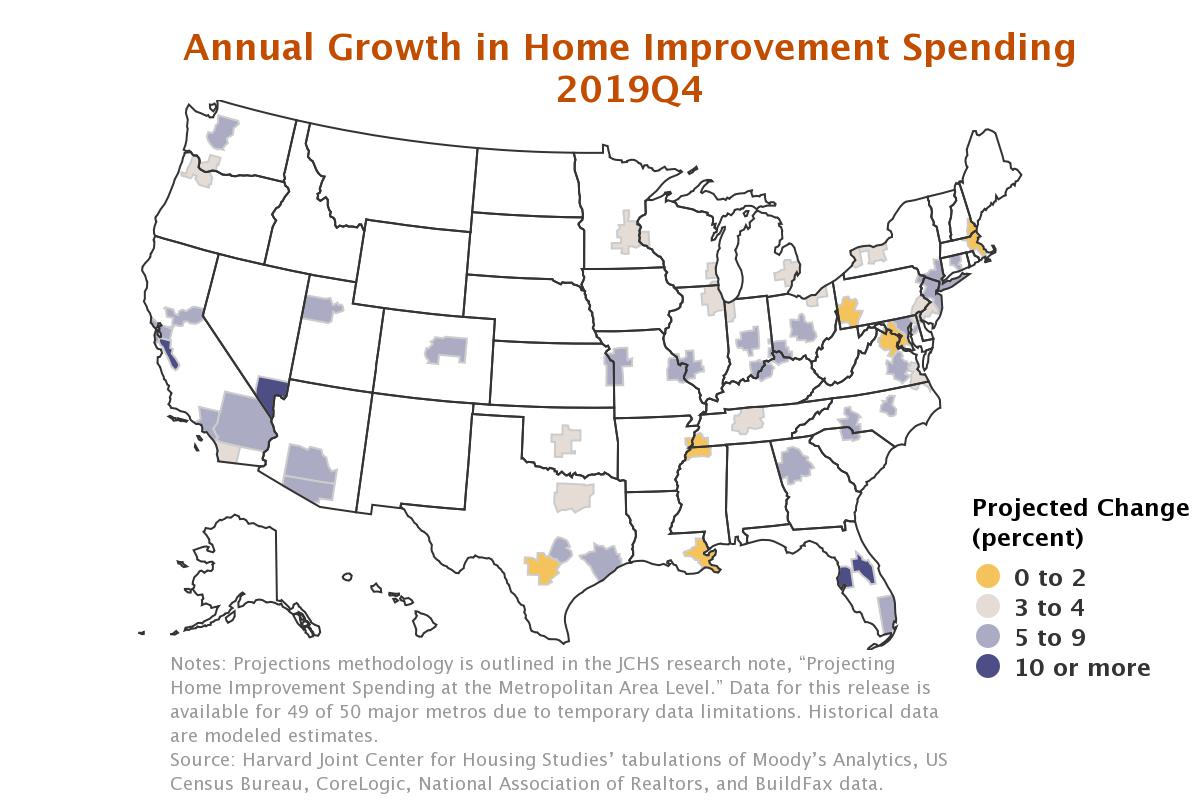

Despite National Slump, Certain Metros See Rises in Remodeling Spend

Even as signs point to a deceleration, JCHS identified a number of markets that should see steady growth in remodeling spend, including Orlando and Las Vegas. The strongest growth will be in the West, where remodeling spend will exceed 8 percent year over year in Sacramento, Denver, Seattle, Tucson, San Jose and Las Vegas. Increases in remodeling spend can be attributed to a healthy housing market, but based on how other indicators perform, it may also suggest homeowners are too hesitant to re-enter the housing market and are instead re-investing in their existing property.

Our most recent Housing Health Report echoed this sentiment. On the metro-level, five of the 10 largest metropolitan statistical areas are still seeing a rise in remodeling activity, which suggests these metros are either withstanding or slow to follow national trends. The two most notable increases were in Philadelphia and Chicago, which rose 15.20% and 5.06% respectively.

For more information on shifts in U.S. home improvement construction activity and its impact on the housing market, contact us today.