We recently published a study on remodeling from three unique perspectives: historical, national, and regional.

The historical perspective is particularly compelling because it reveals a pronounced shift in investments after the housing crisis of 2008.

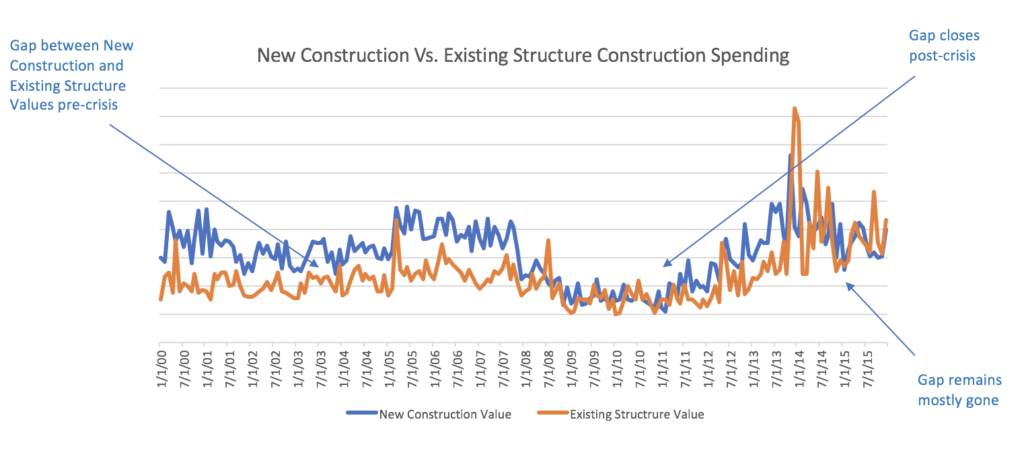

The graph above shows residential new construction and existing structure construction spending throughout the course of the housing crisis. Notice the relatively large gap between the values associated with new construction and existing structures which stays consistent until 2007.

The graph above shows residential new construction and existing structure construction spending throughout the course of the housing crisis. Notice the relatively large gap between the values associated with new construction and existing structures which stays consistent until 2007.

Now look at the two lines from 2008 and beyond. You can see that the gap virtually disappears, which shows that investment in existing structures is keeping pace with investment in new construction. This suggests that a large share of the latest housing boom in real estate prices can be attributed to renovations.

Equity traders and portfolio managers can use this data to identify which types of construction are attracting investments. This can also provide a boost to programs and models, giving informed traders a competitive advantage.

Highlights from the article also include:

- Changes in national residential remodeling growth and spending

- Trends on regional remodeling and how it can affect traders

To read the complete study, “3 Unique Perspectives on the Changing Landscape of Remodeling,” click here.