Flooding may not manifest as severely as other natural disasters, but increasingly, for homeowners, the impact of flooding can pack quite the punch. In the U.S., between 1980 and 2018, flood losses have topped $123.5 billion, of which almost $48 billion is covered by the National Flood Insurance Program (NFIP). Over the past few years, BuildFax flood repair data reveals flood activity and subsequent maintenance has grown even more prevalent. In 2017 alone, flooding in the Midwest and California led to $3.3 billion in losses.

Forecasts from the National Oceanic and Atmospheric Administration (NOAA) indicate that 2019 flood losses will be widespread and cause historic levels of damage. With severe spring hail storms in the rearview mirror and hurricane season on the horizon, BuildFax analyzed flood repair data to reveal how this activity has shifted over the past five years.

Historic Flooding Sheds Light on the 2019 Season

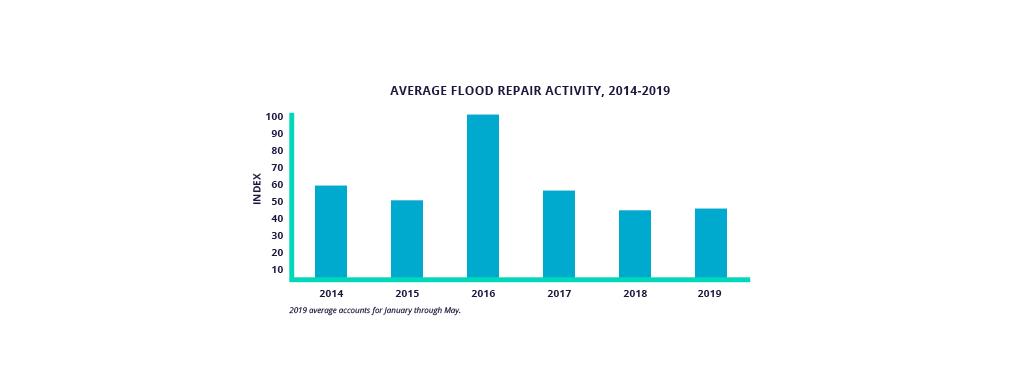

Historically, the U.S. has experienced notable rises in flood-related repairs. In 2016, there were 19 separate severe floods – the most since 1980. To make matters worse, most of the flooding occurred in populated areas, impacting homeowners across the U.S. Our flood repair data indicates, in 2016, activity rose 111.50% year over year. A majority of the repairs occurred between August and December when a series of severe, unprecedented floods damaged properties across the U.S. Two states that saw notable damage include Louisiana and Maryland.

BuildFax insights into 2019 average flood activity mirror these trends. Already, average flood repairs in 2019, between January and May, have surpassed 2018 flood repair activity, even though flood activity typically increases in the latter half of the year. This increased flooding is due to record precipitation – the Midwest and Southeast, including Texas and Louisiana, experienced 200% more rain and snow than they do in an average year.

Hurricane-Impacted States at Risk of Severe Flooding

In the midst of another heavy flood season, carriers should ensure repairs have been completed after flood events. Floods have already impacted a number of Southeast states, however, this is not reflected in repair activity in those regions. Louisiana experienced a 36.01% decrease in flood repair activity year to date over 2018 even though flood activity in the state encompassed the most flood repair work per capita.

Meanwhile, flood repair activity in Florida, where Hurricane Harvey (2017) and Hurricane Michael (2018) made landfall, decreased 18.31%. Florida’s decrease may be a result of elevated activity from last year’s Michael, however, a decrease this substantial suggests other factors may be at play. Given the notable construction labor shortages in the Southeast, exacerbated by Hurricane Michael, homeowners in Louisiana and Florida may not be able to repair their properties as quickly as those in other states.

On the other hand, flood repair data in Colorado, California, New York and Texas suggests these homeowners may be reacting faster to the increases in convective storms and ensuing flood damage. As a result, properties in those areas may have a better risk profile.

In the next few months, insurance carriers have an opportunity to validate the risk on their books heading into hurricane season. Armed with accurate insights, carriers can prioritize good risks by identifying properties that completed post-flood repair work.

For more information on how to elevate your flood insurance strategy, contact a BuildFax representative today.